3 Reasons Affordability Is Showing Signs of Improvement This Fall

A Market That’s Finally Giving Buyers Some Breathing Room

Over the past few years, the story for buyers has been the same everywhere you turned: sticker shock. Home prices surged to record highs. Mortgage rates rose faster than at any point in decades. The result? Many well-qualified buyers stepped to the sidelines, not because they didn’t want to buy, but because the math just didn’t work.

If you’ve been in that boat, you’re not alone. Across the country, millions of hopeful homeowners pressed pause on their search. Many started renting longer than they’d planned. Others began looking at smaller homes or different areas altogether. And plenty just decided to wait.

But as we head into fall 2025, there’s a noticeable shift. For the first time in quite a while, affordability is showing small but meaningful signs of improvement. This doesn’t mean homes are suddenly “cheap”—far from it. But the path to ownership is a little less steep than it was just months ago.

Let’s break down the three big reasons why.

Why Affordability Matters More Than Ever

Before we dive into the specifics, it helps to define affordability. Buying a home is essentially about balancing three things:

-

Mortgage rates – What you’ll pay to borrow money.

-

Home prices – The cost of the property itself.

-

Your income (wages) – What you’re bringing in to cover that cost.

When all three of these work against you—high rates, soaring prices, and slow wage growth—it becomes incredibly difficult to buy. But when even one of them begins to turn in your favor, the math changes. And right now, for the first time in several years, all three are nudging in the right direction at the same time.

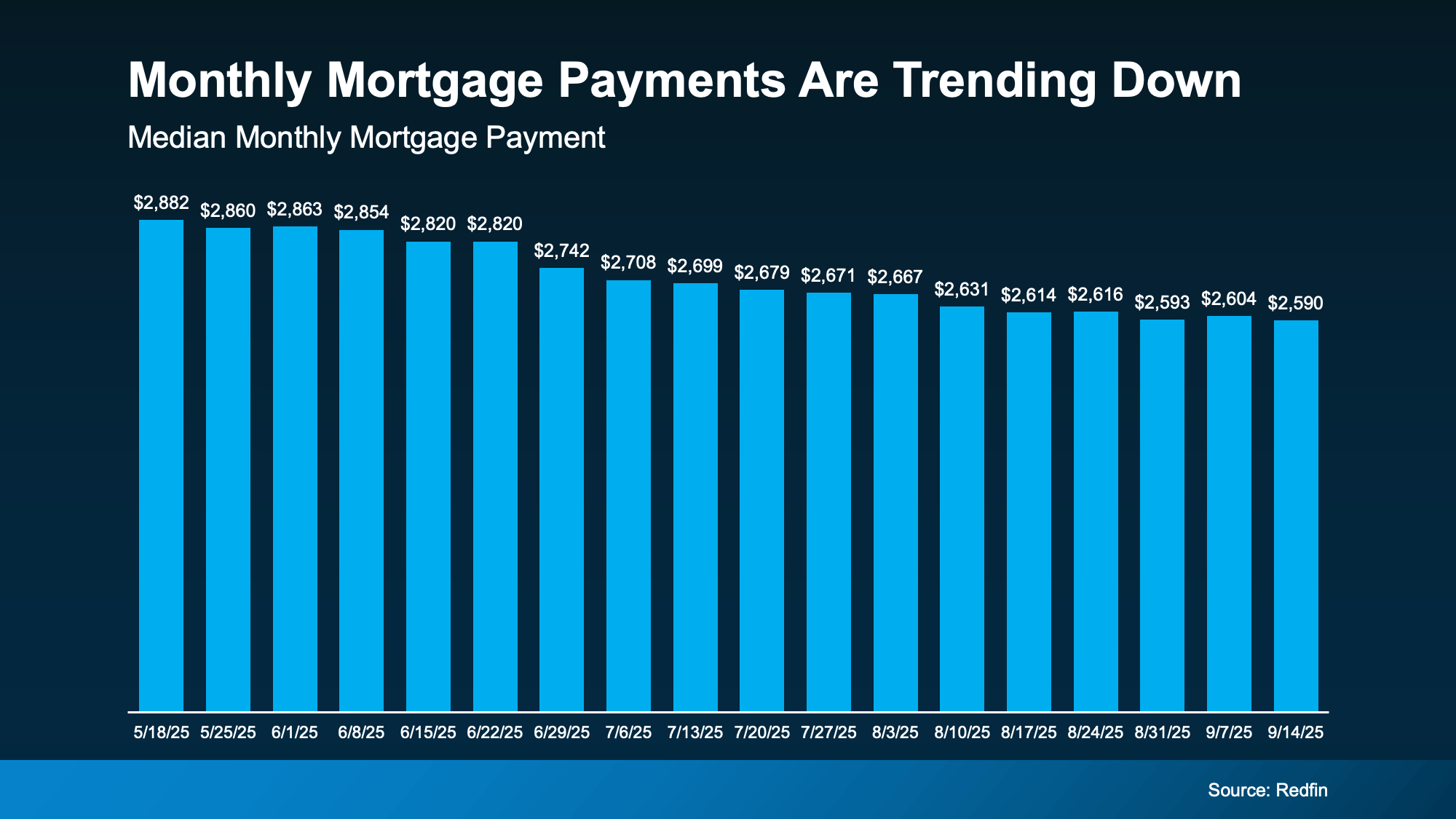

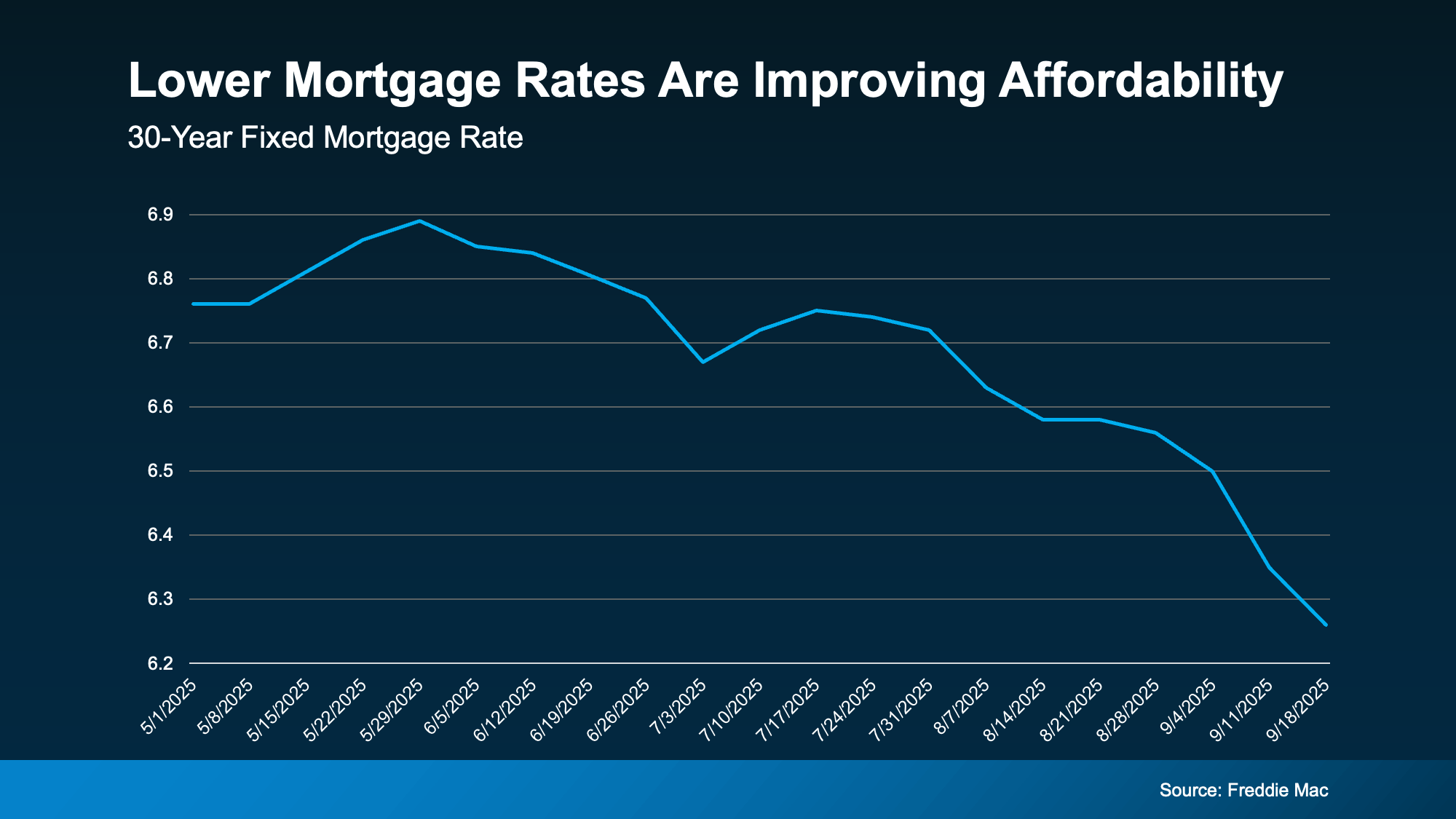

1. Mortgage Rates Are Easing Off Their Highs

Earlier this year, the average 30-year fixed mortgage rate was flirting with 7%. That was enough to price out countless buyers, especially first-timers. Every percentage point higher on your mortgage rate adds hundreds of dollars to a monthly payment.

Now, rates have cooled. The national average has slipped closer to 6.3%, and while that may not sound dramatic, it makes a real difference. For example:

-

A $400,000 loan at 7% equals roughly $2,660 per month (principal and interest).

-

That same loan at 6.3% drops to about $2,470 per month.

That’s nearly $190 saved every single month, just because of the lower rate. Stretch that out over 30 years, and you’re looking at more than $68,000 in savings.

That kind of change can be the tipping point. It’s why Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association, noted:

“The downward rate movement spurred the strongest week of borrower demand since 2022. Purchase applications increased to the highest level since July and continued to run more than 20 percent ahead of last year’s pace.”

Translation: buyers are paying attention, and they’re responding.

Why Rates Moved Down

Rates respond to many factors—Federal Reserve policy, inflation reports, bond market demand, and more. This year, inflation has cooled slightly from the highs of 2022–2023, and investors have shifted expectations about future Fed actions. That’s created a little relief in borrowing costs.

What This Means for You

If you were pre-approved back when rates were 7% and it felt like too much, it’s worth checking again. Even if you qualify for the same price range, your monthly budget will feel lighter. And if you’re comfortable with the payment you budgeted before, a lower rate may stretch your buying power into a slightly nicer home.

2. Home Price Growth Has Cooled Off

For years, the biggest headline in housing was runaway price growth. Between 2020 and 2023, many markets saw double-digit annual increases. That pace was simply unsustainable.

This year, the story is different. Nationally, price growth has slowed to the low single digits. In plain English, homes are still getting more expensive—but much, much more slowly.

Economist Odeta Kushi of First American summed it up:

“National home price growth remains positive, but muted—low single digits—and we expect this trend to continue in the second half of the year.”

For buyers, this shift matters. A $400,000 home growing at 12% a year becomes $448,000 in just 12 months. At 3%, that same home rises only to $412,000. That’s a huge difference in how fast affordability slips away.

Local Variations

While national trends are useful, real estate is always local. Some markets are still tight, with multiple-offer situations. But others are seeing modest price declines as inventory builds and competition eases. If you’re house-hunting, you may notice sellers becoming more realistic on pricing—or even offering concessions like help with closing costs.

Budget Planning Becomes Easier

Slower price growth also makes planning your purchase less stressful. When prices are jumping 10–15% per year, buyers feel pressured to “buy now before it gets worse.” With growth slowing, you have a little more breathing room to compare options and negotiate.

3. Wages Are Catching Up

The third piece of the puzzle is income. According to the Bureau of Labor Statistics, wages are up nearly 4% year-over-year. That may not sound like much, but it’s significant in context.

Why? Because home prices are only rising 2–3% annually right now. That means—for the first time in a while—paychecks are actually outpacing housing costs.

Lawrence Yun, Chief Economist at the National Association of Realtors, explains:

“Wage growth is now comfortably outpacing home price growth, and buyers have more choices.”

That extra boost helps buyers keep up with costs. Even if it’s just a few hundred dollars more per month, it offsets part of the mortgage payment and reduces the sense that homes are running away from you financially.

The Cumulative Impact

Each of these shifts—lower rates, slower price growth, stronger wages—would help affordability on their own. Combined, they create meaningful relief.

Consider the following scenario:

-

Earlier this year: a $400,000 mortgage at 7% on a home that had just appreciated 10% annually, while your income was flat. Ouch.

-

This fall: a $400,000 mortgage at 6.3% on a home rising only 3% annually, while your income is up 4%. That’s a different picture entirely.

It’s still a stretch in many cases, but it’s no longer impossible.

What Buyers Should Keep in Mind

Improving affordability is good news—but it doesn’t mean you should rush blindly into the market. Here are a few tips:

-

Run the numbers with today’s rates. If you were pre-approved six months ago, get updated figures. Your budget may look better now.

-

Look at local inventory. Some neighborhoods are stabilizing, while others remain ultra-competitive. A good agent can help identify where your dollars go furthest.

-

Consider long-term plans. Even if affordability is improving, buying is still a major commitment. Make sure the home fits your lifestyle for at least 5–7 years.

-

Don’t wait for “perfect.” Many buyers sit on the sidelines waiting for the market to crash. Most economists agree that’s unlikely. Improvement in affordability doesn’t mean prices will fall dramatically—it just means the pace has cooled.

What This Means for Sellers

Interestingly, these shifts also create opportunities for sellers. More buyers re-entering the market means more competition for listings. If you’ve been thinking of selling, fall could be a strategic time. You’ll be meeting buyers who feel encouraged rather than defeated by the math.

Final Thoughts: Is Now the Right Time for You?

The housing market is still challenging. No one is pretending that affordability has magically returned to pre-2020 levels. But compared to where we’ve been, this fall represents a notable improvement.

The key takeaway: it may finally be possible for you to buy the home you’ve been waiting for.

-

Rates are lower than they were in spring.

-

Prices are stabilizing instead of skyrocketing.

-

Wages are giving you a bit more financial breathing room.

Together, those factors make this season one of the most buyer-friendly in recent memory.

Bottom Line

If you’ve been wondering whether it’s time to take another look at buying, now may be the right moment. The numbers aren’t perfect, but they are better—and better can be enough.

Let’s sit down, go over your budget, and figure out whether this fall is the time to move from browsing listings to unlocking your own front door.

Categories

Recent Posts

GET MORE INFORMATION